|

|

|

|

| |

Dear Reader,

In recent years, philanthropy has emerged as a central pillar of wealth management for Ultra High Net-Worth (UHNW) families, particularly in the context of Family Offices. Traditionally focused on wealth preservation and growth, Family Offices are now increasingly integrating social impact into their core practices, reflecting a broader shift towards ethical capitalism and responsible wealth creation.

Family Offices are uniquely positioned to bridge the gap between financial success and social responsibility. They offer a platform for UHNW families to not only manage their wealth but also direct it towards causes that resonate with their values. In this context, philanthropy is no longer seen as a one-off charitable donation but as a long-term, strategic endeavour that can create sustainable change. Many families are establishing dedicated philanthropic trusts, ensuring that their charitable efforts endure across generations and make a tangible difference in society.

The next generation of wealth custodians is particularly keen on shaping a legacy that transcends financial success. Today's younger UHNW individuals are increasingly socially conscious and eager to contribute from an early age. Family Offices are fostering this philanthropic mind-set by involving younger members in charitable activities and educating them about the power of wealth to create positive societal change. By instilling these values, Family Offices help ensure that future generations not only inherit wealth but also the responsibility to use it Wisely.

At its best, philanthropy within a Family Office is a holistic practice, aligned with the family's values and vision, and embedded into the fabric of wealth management. In the evolving landscape of Family Offices, philanthropy is no longer a side concern but a cornerstone of responsible wealth stewardship.

ET this month looks at 'Philanthropy and the Family Office'.

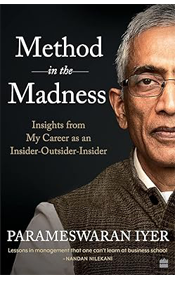

In the Thinking Aloud section, Jay highlights that Family Offices have the potential to shape transformative philanthropy by leveraging patient capital to address root causes and create long-term solutions, yet many currently focus on short-term, conventional charitable efforts rather than pioneering bold, game-changing initiatives. On the Podium, Rajmohan Krishnan, Principal Founder & MD, Entrust Family Office discusses the evolving role of philanthropy within Family Offices in India, emphasizing the importance of aligning wealth management with societal impact, fostering long-term, community-driven initiatives, and guiding future generations to embrace philanthropy as a core value. In the We Recommend section, we review Method in the Madness which is an account of Parameswaran Iyer, a former Indian government secretary, as he reflects on his unique career journey - from IAS officer to World Bank technocrat, and back to lead the transformative Swachh Bharat Mission - offering inspiring management insights, career advice, and life lessons.

In Figures of Speech, Vikram's toons share some food for thought!

Please also Click Here to check out our Special issue of ET, which is a collation of selected themes that were featured over the years highlighting the changing landscape of the business world. This special edition has been well received and can be Downloaded Here for easy reading and is a collector's item.

As always, we value your opinion, so do let us know how you liked this issue. To read our previous issues, do visit the Resources section on the website or simply Click Here. You can also follow us on Facebook, LinkedIn, X, Threads & Instagram - where you can join our community to continue the dialogue with us!

|

Out Now!

Succeeding in Business: Nurturing Value in Family Business

Click below to order your copy now

|

|

Special offer for Empowering Times readers. Get 30% discount by using coupon ETSPECIAL on the Notion Press online store.

Click here to connect with Jay.

|

|

|

|

|

'Love of humanity' - the literal meaning of the Greek word philanthropy - seems possible in today's material world only if there is money in the picture. Therefore, it is often difficult to convince well-meaning people that support can be offered through other gifts in the form of time and talent, as that too can ameliorate the current situation of those in need.

The other element that is often debated is whether charity is the same as philanthropy. Though akin, the essential difference is that charity is primarily an individual-driven step to assist the needy whereas philanthropic movements tend to address deeper malaise for larger good. The analogy that comes to mind is the difference between applying band-aid to a wound as against undertaking a holistic wellness program, where the intent is to remedy deep-rooted challenges and prevent them from recurring. While similarities abound, the true differentiation is that philanthropy extends for a larger time horizon, as the mission or purpose of the intervention is more comprehensive in nature and scope.

Understandably the financial lubricant is most coveted by agencies that seek support. Consequently, the role of the ultra-high net worth individuals or families comes into focus. After all, much is expected from those who have been fortunate to be blessed with largesse that society has provided to them. It is often remarked that Andrew Carnegie was the first philanthropist in the modern sense of the term. But the role of Jamsetji Tata was arguably no less, according to those who have researched the field. While the western world acclaims its large number of Givers, the rise of social consciousness in the wealthy class of India is also noteworthy. An interesting highlight of the EdelGive-Hurun India Philanthropy List for this year is that the wealthy have not hesitated to offer more to causes that they cherish. They further mentioned that donation figures indicate that there is significant rise (55%) since 2022, and collectively nearly Rs. 9K crores have been deployed by over 200 philanthropists. Besides the usual favourite causes - education, healthcare and rural development - there is also support for conservation of environment, an important issue when the world is facing the ravages of climate change.

The rising number in this enviable list is not only the natural outcome of the growth trends in the economy, but also perhaps parallels the upsurge in the way wealth is managed today. Reports indicate that Family Offices are in their growth phase in India: in 2018 it was 45 and today it is over 300 (both single family and multi-family offices). Clearly, the rich desire to be serviced with customized solutions as against the vanilla offerings of standard wealth management arms of the banking channels. The larger Offices have also refined themselves to offer a portfolio of services: going far beyond managing and investing money, to concierge assistance, real estate management, and legal offerings, and other novel activities.

A bone that one can pick with them is that while many speak of advisory work on philanthropy, barely a few have been agenda setters. Largely, the Family Offices are order takers - quite legitimately so, one may add - and have not ventured into shaping the philanthropic potential, and thereby differentiating both the Family and their role as an innovative Advisor. This is largely because the Advisors themselves have not educated themselves about causes that are truly game-changing in nature. This is not to deny that social causes pursued by the majority of families are irrelevant - after all, there is so much that one can do to uplift the rural distressed, be it through education, health, livelihood, sanitation, etc. However, my concern is that we continue to provide solutions that are vital for today without taking a proactive, transformational moonshot which can prevent some of these aberrations from recurring. Take the case of assisting malnourished school-going children: there can be no debate that they need assistance. The laudable action in such cases is to provide them nourishment and healthcare assistance. Welcome though this is, it is a normative action that is repeated ad nauseam, year-in and year-out. For a lasting and sustainable solution wouldn't it be better to consider funding scientific research that addresses nutritional challenges and maternal health at pregnancy?

There are many other such quantum changes that can be initiated, if one studies root causes and tackles basic issues. In my view, Family Offices can play a seminal role in shaping bold and creative investments of entrepreneurial families. By definition, wealthy families have patient capital that can wisely deployed to better tackle society's perennial malaise. We often forget that it is thanks to Jamsetji Tata's foresight that the Indian Institute of Science was created and is today credited as a national treasure. The seed planted by a visionary and outstanding philanthropist is today a thriving tree, which in turn has inspired other institutions. Where are such visionaries who are willing to bet big on science as the lever of change? Sadly, conspicuous consumption seems to be the primary occupation of the super-wealthy of our nation.

Quantity alone (number of players) should not define a sector; it is incumbent on the leaders of the sector to shape innovative action. Can the leaders in the Family Office sector rise to this test and pick up the gauntlet?

back to top ^

|

|

|

|

Rajmohan Krishnan (a.k.a Raj) leads the team of Entrustians' with his relationship-centric service mind-set and uncompromising professionalism, which has established Entrust as a pioneer in the pure breed Family Office space. With his deep understanding of the financial services industry and over two decades of advisory experience across a wide spectrum like Real Estate, Business Succession, Estate Planning and Social enterprises Investments, etc., Raj is one of the most renowned Family Office advisors in the country.

Rajmohan Krishnan (a.k.a Raj) leads the team of Entrustians' with his relationship-centric service mind-set and uncompromising professionalism, which has established Entrust as a pioneer in the pure breed Family Office space. With his deep understanding of the financial services industry and over two decades of advisory experience across a wide spectrum like Real Estate, Business Succession, Estate Planning and Social enterprises Investments, etc., Raj is one of the most renowned Family Office advisors in the country.

Raj was one of the founding team members of Kotak Wealth Management and was responsible for the P&L across the North and South India Regions. Resultantly, Raj has mentored some of today's successful wealth managers in the country at various points in time. Clients and peers alike acknowledge his ability to weave in practical solutions and improvements. He is a postgraduate of the University of Madras and an alumni of executive programs conducted by the Indian School of Business and IIM Ahmedabad.

Raj is an avid golfer and a devoted art enthusiast. He is a fan of Carnatic classical music and has founded the Entrust Foundation to support art, culture, and elderly care. Recently, Raj made his debut in the literary world with his book 'Wise Wealth'. The book is a curation of heartfelt conversations with some of India's foremost industrialists, entrepreneurs and change makers who are ardent believers and practitioners of the philosophy of wise wealth.

Raj believes that one must embody the spirit of giving in every sphere and circle of life. Family members, colleagues, clients, communities, and the whole of society must benefit from an individual's talents, persona, and achievements.

ET: Can you share insights on the evolving landscape of philanthropy within the Family Office, particularly in India?

RK: The landscape of philanthropy within Family Offices has evolved significantly in recent years, especially in India. Traditionally, Family Offices focused primarily on wealth preservation and growth, but today, more UHNW families are prioritizing societal impact in ways that align with their values and life experiences. Most large families have unique preferences for giving - they support causes that resonate deeply, often shaped by personal or family experiences. Many have set up their own philanthropic initiatives, and while they are passionate about these efforts, they often seek assistance in managing the operational details to maintain long-term effectiveness. To support this, a separate trust structure can be established, allowing for sustained impact over generations, managed independently to uphold the family's philanthropic vision.

ET: What are some common misconceptions about philanthropy among the Ultra High Net-worth Families (UHNFs) in India and how do you address them?

RK: A common misconception among UHNW families is the belief that impactful philanthropy requires vast wealth, while meaningful contributions can begin at any scale. Another misconception is that large one-time donations alone create change, without considering the importance of strategic planning and continuity. Many families already have specific causes close to their hearts, but they may underestimate the operational requirements of managing these efforts for long-term impact. We help clients establish structured approaches and recommend forming a dedicated trust to manage and sustain their philanthropic work. This approach allows them to fulfill their charitable goals with consistent oversight, ensuring that their efforts yield lasting benefits to society.

ET: 'Charity may work for individuals, but what we really need are solutions that benefit entire groups'. Request your comment on this aspect as an Adviser to UHN families.

RK: As an adviser to UHNW families, I believe that while individual charity can address immediate needs, creating a broad, enduring impact often requires a more comprehensive approach. Effective philanthropy for UHNW families can be achieved through initiatives that benefit entire communities. Many UHNW families are deeply passionate about causes informed by personal experiences, and while they often establish their own philanthropic ventures, they frequently seek operational support to maximize impact. A Family Office can guide these initiatives to be community-driven and self-sustaining by recommending the establishment of a trust that operates independently. This long-term structure ensures that the family's vision endures beyond individual donations, creating a legacy that addresses root causes and benefits generations to come.

ET: You run a very successful Multi Family Office. Please share what steps are taken to inculcate the value of philanthropy in the next generation in Ultra High Net-worth families.

RK: To foster the value of philanthropy in the next generation, we emphasize the principle of Wise Wealth - understanding that wealth becomes truly meaningful when used to benefit society. Founders of family wealth often focus on philanthropy later in life, but today's younger generation is increasingly socially aware and eager to contribute early on. Many UHNW families actively involve their younger members in philanthropic activities from the beginning, nurturing a philanthropic outlook that grows with them over time. By encouraging the next generation to see wealth not only as a financial asset but also as a tool for sustainable, positive impact, they learn to honor their family's values and leave a legacy for future generations. A dedicated philanthropic trust further supports this by providing a structured platform for younger family members to engage with and carry forward the family's social vision.

ET: As an advocate of wise wealth and enabling legacy, what advice would you offer to Family Offices looking to incorporate philanthropy into their wealth management practices?

RK: Family Offices today have a unique opportunity to embrace philanthropy as part of ethical wealth management, a shift aligned with the rise of ethical capitalism. Many new and established UHNW families in India are moving beyond writing cheques - they want to ensure their contributions make a tangible, positive difference in society. This hands-on approach requires that Family Offices bring the same high standards to philanthropy that they apply to wealth management.

At Entrust Family Office, we focus on Wise Wealth: helping clients create wealth transparently, grow it responsibly, and ultimately use it to benefit themselves, their families, and society. Wise Wealth reflects a full cycle of capital - from creation to impactful disbursement.

For Family Offices looking to incorporate philanthropy, I recommend three areas of focus:

- Encourage a Long-Term Perspective: Guide clients in building a stable portfolio that allows them to focus on philanthropic goals without frequent distractions from market volatility.

- Establish a Dedicated Philanthropic Trust: A trust enables families to formalize their philanthropic efforts as a separate, long-term entity. It provides a stable structure for day-to-day operations and ensures the family's vision endures over generations, with the flexibility to adapt as societal needs evolve.

- Provide Operational Support for Philanthropy: Managing a trust or foundation requires a skilled team and operational oversight. A Family Office can support these initiatives by coordinating with trusted NGOs or facilitating partnerships, enabling clients to focus on strategic goals while ensuring their contributions yield lasting, impactful outcomes.

Ultimately, the future Family Office will be central in guiding clients to pursue Wise Wealth, encompassing not only financial growth but a lasting legacy and positive societal impact.

back to top ^

|

|

|

|

In his memoir, Method in the Madness, Parameswaran Iyer takes readers on an insightful and inspiring journey through the transformative Swachh Bharat Mission (SBM), one of the most ambitious sanitation projects in India's history. Drawing on his personal experiences and leadership in the SBM, Iyer unveils the mission's triumphs, challenges, and the transformative impact it had on millions of lives across the country.

The book opens with a candid look at the deeply ingrained habit of open defecation in India, a practice that had persisted for centuries despite growing public health concerns. The SBM, initiated in 2014, faced the monumental task of changing these age-old behaviors. Iyer's narrative effectively demonstrates how the SBM overcame this challenge not only through policy initiatives but by deeply embedding itself within local communities. The inclusion of grassroots-level interventions, such as the Swachhagrahis (village motivators), and media campaigns featuring celebrities, played a crucial role in nudging behavior change in the most rural and resistant communities.

What sets this memoir apart is Iyer's detailed account of the behavioral economics behind the mission's success. Inspired by Richard Thaler's theory of nudging, the SBM implemented strategic "nudge" tactics, including emotional triggers like disgust to build awareness about the importance of sanitation. The story of a Swachhagrahi demonstrating the dangerous effects of flies transferring bacteria from feces to food is one powerful example of this approach. These personal stories, combined with the larger policy framework, illustrate the complexity and scale of the SBM's implementation.

In addition to showcasing the mission's successes, Iyer also doesn't shy away from the program's criticisms. He reflects on the challenges posed by media misinterpretations, the obstacles of scaling at a national level, and the program's flaws. However, Iyer emphasizes the importance of transparency and proactive communication to address misinformation. The SBM team took significant strides in countering misleading reports and, over time, turned critics into supporters by consistently providing accurate data and aligning the mission with broader public health benefits.

One of the most captivating parts of the book is Iyer's work beyond rural India, aiming to make sanitation a national priority. He recounts his meetings with key policymakers, which resulted in the mission's emblem - the iconic glasses of Mahatma Gandhi - being featured on the Indian currency. These achievements were also bolstered by celebrity endorsements, including the collaboration with Bollywood actor Akshay Kumar on the film Toilet – Ek Prem Katha, which further propelled the mission's message of sanitation as a human right.

The author also discusses the SBM's international impact, underscored by the Mahatma Gandhi International Sanitation Convention, which attracted global attention and highlighted the four pillars of SBM's success: political leadership, public financing, partnerships, and people's participation. These pillars were essential to SBM's success, as they enabled the mission to scale while remaining community-driven.

Throughout his tenure, Iyer worked under the guidance of India's Prime Minister, Narendra Modi, using political leadership to garner support and create momentum for the mission. He highlights the importance of having strong leadership to drive ambitious national projects. The book also offers a glimpse into the personal side of Iyer's leadership journey, detailing the moments of recognition, like the unexpected praise from the Prime Minister at an event in Champaran, as well as the complex dynamics of dealing with criticism and managing media interactions.

Iyer's reflections on the importance of a diverse team, combining young professionals, development partners like UNICEF, and seasoned civil servants, offer valuable insights into the mechanics of driving large-scale public policy initiatives. His recognition of the power of both external perspectives and internal teamwork exemplifies the collaborative spirit that underpinned SBM's success.

The book concludes with a deep reflection on the future of sanitation and the shift toward a new focus: providing piped water to rural India. It also touches on Iyer's role in managing the COVID-19 pandemic, which disrupted the world, but also became a test of the SBM's resilience and adaptability. Despite the challenges, the SBM team kept pushing forward, ensuring the continuation of Phase-II amidst the national crisis.

The read is more than just a tale of a national sanitation campaign - it's a story of resilience, innovation, and leadership. Iyer masterfully blends personal anecdotes with strategic insights to highlight the power of behavior change, policy, and community engagement in transforming a nation. This book is a must-read for those interested in public policy, social change, and the power of leadership in achieving large-scale transformation.

back to top ^

|

|

| |

|

THROUGH THE LENS

|

|

|

Nature photographer Rupesh Balsara spots the Caspian Tern a large, migratory seabird that occasionally visits coastal regions of India, primarily during the winter months. The Caspian Tern is typically found along the west and east coasts, including areas like Gujarat, Maharashtra, and the Sundarbans. It prefers sandy beaches, mudflats, and estuaries where it feeds on fish, often diving from the air to catch its prey. Although not considered a common resident, its presence is notable in the winter and during migration periods. Conservation efforts are important for protecting its habitat, which is increasingly threatened by human activities and environmental changes.

|

|

|

|

Empowered Learning Systems

www.empoweredindia.com

101, Lords Manor, 49, Sahaney Sujan Park,

Lullanagar, Pune – 411040,

Maharashtra, India

|

The ELS Lotus logo is trademark of Empowered Learning Systems The ELS Lotus logo is trademark of Empowered Learning Systems

©2024 Copyright Empowered Learning Systems (ELS). For private

circulation to clients and well-wishers of ELS. While ELS endeavors to ensure

accuracy of information, we do not accept any responsibility for any loss or

damage to any person resulting from it.

|

|

|

|

|

|

| |